Industry Pain Points

Traditional Data Warehouses Are Unsustainable

Traditional data warehouses built in earlier times struggle to support the surge in data, encountering bottlenecks in data processing performance.

Widespread Data Distribution

Data is produced from numerous sources, and integrating a large volume of heterogeneous data is challenging, leading to issues of data silos.

Heightened Security Requirements

Due to the financial nature of industry data, there is a need for better security mechanisms to protect sensitive data such as user information and transaction details.

Insufficient Data Timeliness

The demand side, including marketing, investment research, operations, and investment advisory, has increased requirements for data timeliness. Offline data processing cannot meet these scenario needs.

Intelligent Transformation Is Urgent

In the transition from traditional to intelligent applications, traditional technologies struggle to deeply extract data value to support the intelligent transformation of the fund industry.

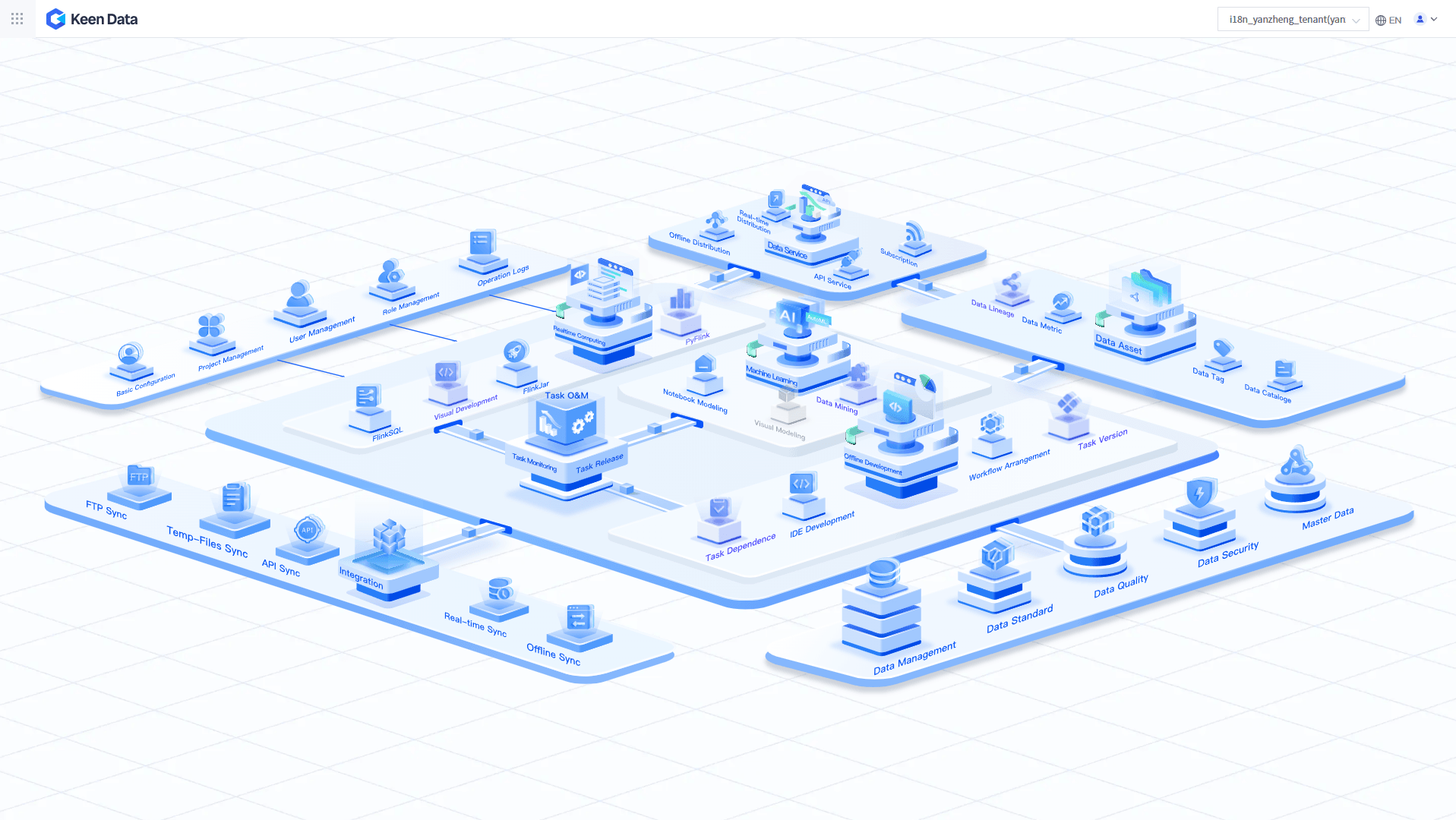

Solution Architecture

Customer Benefits

Massive Data Support

The big data platform built on distributed systems can support computation and exchange of data volumes in the petabyte (PB) range and beyond.

Heterogeneous Data Integration

A batch-streaming integrated data synchronization system supports the connection, integration, and accumulation of massive heterogeneous data.

Data Security Assurance

Unified data management, resource management, permission systems, and data audits isolate risks of data breaches and protect sensitive data.

Real-Time Scenario Support

Utilizing streaming synchronization systems and real-time computing platforms, real-time application analysis is conducted on data such as real-time trading behaviors generated by fund transactions.

Intelligent Innovation

Through the algorithm service capabilities of visual modeling and model publishing on scientific platforms, innovative support for new business models and scenarios is enabled.

Customer Cases

Build Your AI-Native Data & AI Platform with KeenData